Computation of gross profit

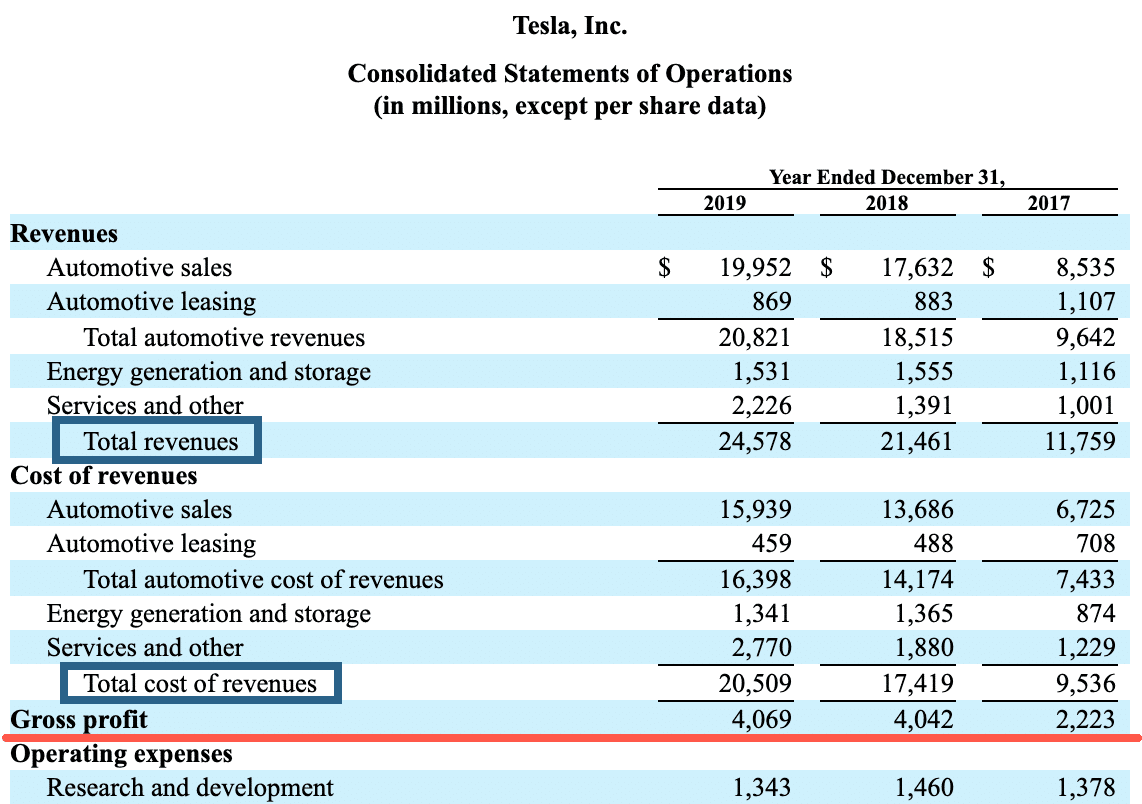

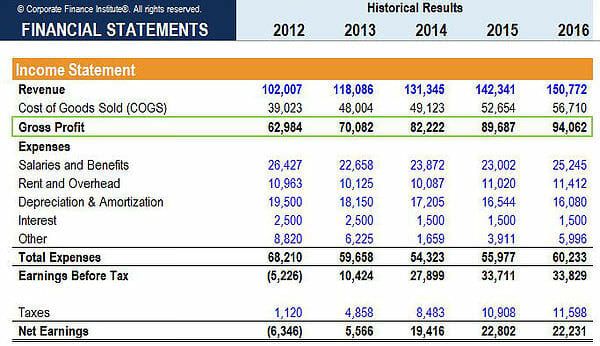

If these represent all of our revenue sources we can say that our total income is P20000 P7000 P3000 P30000. You can find Gross Profit on a companys income statement and its calculated by subtracting the cost of goods sold COGS from the companys total sales revenue.

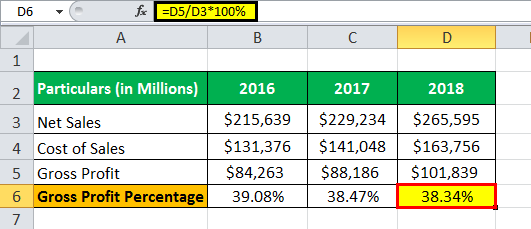

Gross Profit Percentage Formula Calculate Gross Profit Percentage

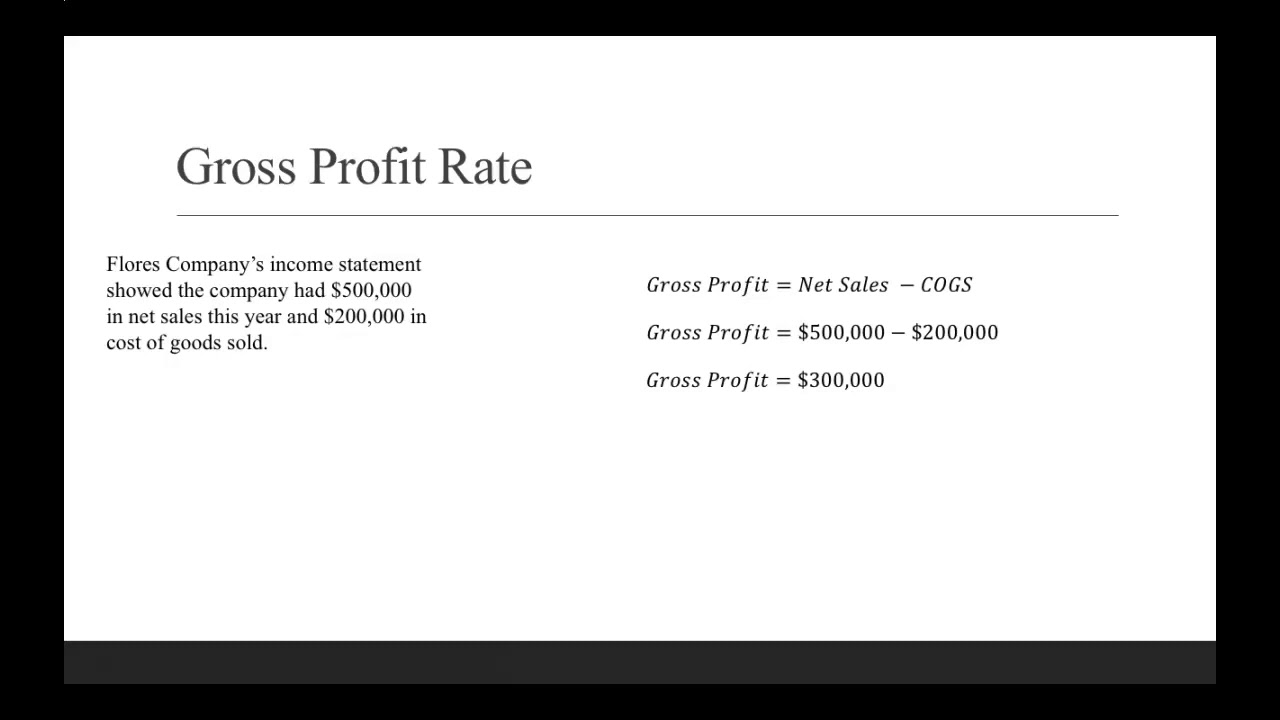

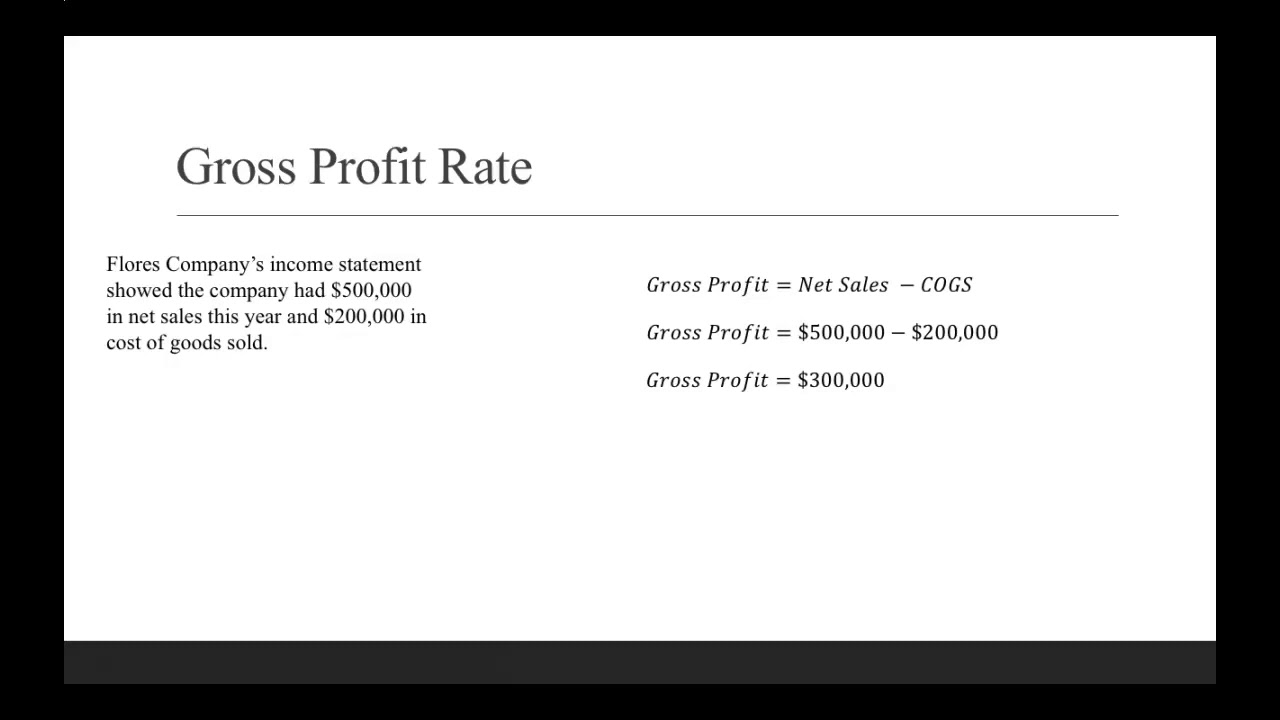

The gross profit formula is.

. Gross Profit Margin 500000. You can calculate your gross profit with the following formula. Gross Profit Sales Purchases Direct Expenses Now there are times when a company may choose to report separate items in the sales revenue section of the income.

How to calculate gross profit Example of a gross profit. Getting the difference between. Gross Profit Sales Gross Profit Margin There are two key ways for you to improve your gross margin.

Lesson 1 Compute for profits. Gross profit is the profit a company makes after deducting the costs associated with making and selling its products or the costs associated with providing its services. The gross profit margin is computed as follows.

Gross Profit Margin Formula. Find Gross profit and its percentage. Gross Profit Margin Revenue Cost of Goods Sold Revenue.

First you can increase. Gross Profit Ratio Gross ProfitNet Revenue of Operations 100 The Gross Profit ratio indicates the amount of profit that is available to cover operating and non-operating. This module is divided into two lessons.

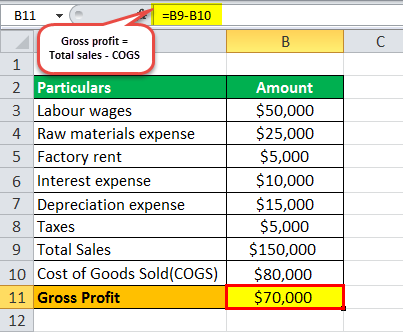

Up to 8 cash back Gross profit calculation Gross profit is revenue minus the cost of providing the goods or services sold. Cost of goods sold cost of raw. Computation of Gross Profit 1.

Gross Profit Margin Sales - Cost of Goods Sold Sales OR Gross Profit Total Revenue Gross Profit Margin Definition The Gross Profit Margin Calculator will. Gross Profit Total Sales Revenue Cost of Goods Sold In this gross profit formula the total sales revenue is the money that the business has. Gross profit Total sales Cost of goods sold 120000 63000 57000 Working note.

Divide gross profit and the net sales revenue and multiply by 100 Once you have the gross profit and net sales revenue. Gross Profit Revenue - Cost of Goods Sold Revenue Revenue is the total money your company makes from its products and. Gross profit percent 87000 162000 x 100 3.

5 CO_Q2_Entrepreneurship SHS Module 8 The ultimate goal of any business whether a retail or wholesale is to earn a profit. How to Calculate Gross Profit Margin A companys gross profit margin percentage is calculated by first subtracting the cost of goods sold COGS from the net sales gross. Now we will calculate the gross profit by using data given Gross profit Total sales COGS 150000 80000 Gross profit 70000 Therefore the calculation of gross profit.

You can multiply the resulting number by 100 for a percentage.

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Gross Profit Margin Formula And Calculator Excel Template

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Gross Profit Margin Vs Net Profit Margin Formula

What Is Gross Profit Definition Formula And Calculation Stock Analysis

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating Profit And Net Income

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Calculating The Gross Profit Rate Youtube

Gross Profit Essentials You Need To Know About Gross Profit

What Is The Gross Profit Margin Bdc Ca

The Gross Profit Formula Lower Costs Raise Revenue Quickbooks Australia

Computation Of Gross Profit Entrepreneurship Q2m8 Youtube

Gross Profit Margin Formula And Calculator Excel Template

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)

Gross Profit Vs Net Income What S The Difference

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

How To Calculate Gross Profit Margin And Net Profit Margin